Timing vs Time: Why starting your SIP today matters more than market predictions

Timing vs Time: Why starting your SIP today matters more than market predictions

When is the right time to invest? Many of us wonder, “Abhi invest karu ya thoda ruk jau?”

Markets fluctuate and there’s always something new happening, so it can feel like there’s never a perfect time. Sometimes, waiting for the right moment can mean missing out altogether.

Because in investing, “timing the market” tends to matter less than “time in the market.”

What matters is starting early and staying consistent – though outcomes may vary.

The “timing the market” myth.

Many investors wait for the right time to enter,

“When the market falls, I’ll invest.”

“When the elections are over.”

“When interest rates drop.”

The examples provided are for illustrative purposes only.

Predicting market movements consistently is extremely difficult, even for experienced professionals. Markets react to numerous factors like global events, government policies, earnings data, investor sentiment most of which are unpredictable. Staying invested for longer periods may allow compounding to work, which may help in pursuing your long-term financial journey.

Understanding Rupee Cost Averaging

Let us make it simple with an illustration.

Ravi starts a ₹5,000 monthly SIP in a mutual fund scheme.

Here’s how his investment behaves over four months:

| Month | NAV (Rs. per unit) | Units Bought | Investment (Rs.) |

|---|---|---|---|

| January | 50 | 100 | 5,000 |

| February | 40 | 125 | 5,000 |

| March | 25 | 200 | 5,000 |

| April | 50 | 100 | 5,000 |

| Total | 525 Units | 20,000 |

Note – The table shown above is solely intended to illustrate the concept of Rupee Cost Averaging and should not be interpreted as an indication of performance in any manner.

Now, Ravi’s average cost per unit = ₹20,000 ÷ 525 = ₹38.10 per unit. That’s the potential benefit of Rupee Cost Averaging!

You invest a fixed amount regularly, buy more units when the market is low, and fewer when it’s high, automatically averaging your cost and potentially reducing the impact of volatility.

Timing the market

Trying to predict market highs and lows often causes stress and missed opportunities.

It’s like trying to catch the perfect wave in the ocean, while others are already surfing regularly catching many imperfect waves.

When you focus on time in the market, you let the market work for you.

Volatility can be challenging, but SIPs can help to manage its impact through rupee cost averaging.

Remember:

- You can’t control the market.

- But you can always be a disciplined investor.

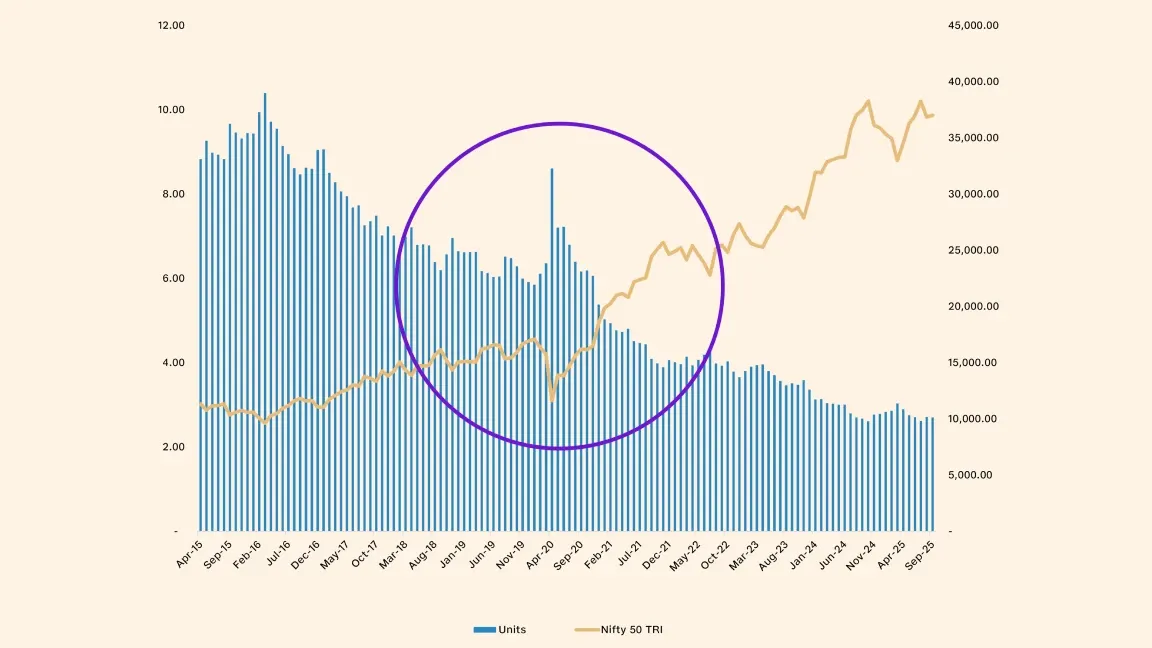

You buy more units when the market falls

Source: Nifty Indices. Data as on 30th Sep 2025. Assuming monthly SIP investment amount of Rs. 1,00,000. Units derived based on Nifty 50 Total Return Index (TRI) levels. Calculation internal. Past performance may or may not be sustained in future and is not a guarantee of any future returns. The above graph is for understanding and illustrative purposes only. This graph is solely intended to illustrate the concept of Rupee Cost Averaging and should not be interpreted as an indication of past performance. Investors cannot invest directly in an index. Indices have other material characteristics that may differ from the Scheme. Investors can consult their financial advisors before making any investment related decisions.

Let’s take an example. Imagine you decide to invest ₹1,00,000 every month in the stock market through an SIP linked to the Nifty 50 Total Return Index (TRI). The golden line in the graph shows how the Nifty 50 TRI (market value) moves. The blue bars show how many units you get for your investment of ₹1,00,000 each month.

Here’s the key part:

- When the market falls, the price per unit is lower, so your ₹1,00,000 can potentially buy more units.

- When the market rises, the price per unit is higher, so you can get fewer units.

Over time, this process, buying more when prices are low and less when prices are high, is called Rupee Cost Averaging. This approach may help investors accumulate more units during market downturns and can potentially reduce the impact of market timing on long-term returns.

Why SIPs work?

- Discipline: SIPs automatically invest a fixed amount monthly for your financial journey.

- Affordability: You can start small even with ₹250 a month and aim to grow gradually.

- Compounding power: The earlier you start, the more time your money gets to grow.

- Flexibility: You can pause, increase, or stop SIPs anytime.

- Financial Targets: Ideal fit for long-term financial targets like your child’s education, retirement, or that dream home.

Market fluctuations and SIPs

Yes, markets fluctuate but volatility is temporary; growth is long-term.

When you invest through SIPs:

- You can benefit from Rupee Cost Averaging

- You can reduce the pressure of timing the market.

- And you stay on track for your financial journey.

So, the next time someone says, “Market mein risk hai,”

you can confidently reply,

“Haan, isliye toh SIP kar raha hoon!”

Because SIP doesn’t just have potential to manage risk, it can also help you turn volatility into opportunity.

Final Thought

You don’t need to wait for the “perfect” market moment.

Consider starting early and investing regularly. Over time, disciplined investing through SIPs may help manage market fluctuations.

Let the power of Rupee Cost Averaging and time work for you.