JioBlackRock Sector Rotation Fund: A Strategy for Dynamic Market Navigation

JioBlackRock Sector Rotation Fund: A Strategy for Dynamic Market Navigation

Markets tend to move in cycles. Certain sectors may soar one quarter, while the others can lead the next. What stays constant is change itself. For investors, the real challenge often is not identifying good sectors but knowing when each sector is likely to perform.

This is where sector rotation funds can come in. Instead of committing permanently to a fixed set of sectors, these funds dynamically adjust their portfolios based on changing market conditions. In a fast-evolving economy like India, this adaptive approach can become increasingly relevant.

The Opportunity: JioBlackRock Sector Rotation Fund

It is an open ended equity scheme that tilts its sector weights based on investment insights and prevailing market conditions. What sets this fund apart is the combination of global investing expertise and advanced analytics, bringing institutional-grade processes to retail investors.

How the Investment Process Works

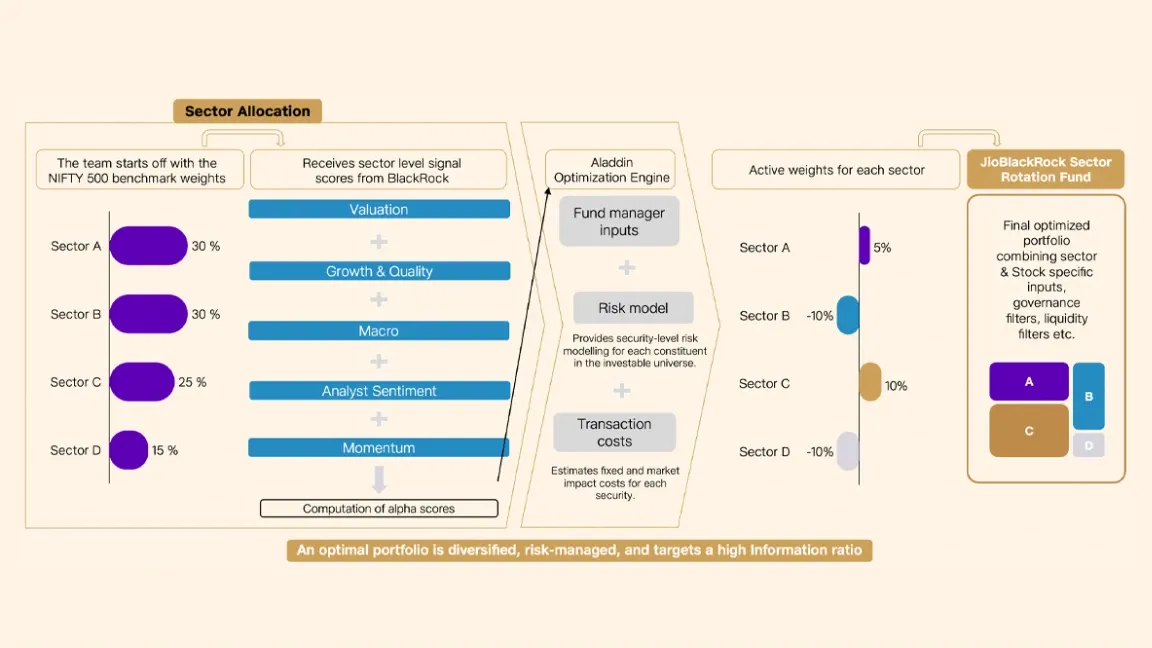

At the core of the fund is a Systematic Active Equity (SAE), a technology-driven investment approach that combines human expertise with a data-driven model to build a portfolio.

Aladdin® is BlackRock’s proprietary platform which is licensed to the JioBlackRock AMC. The above representation is for illustration purpose only. The Information Ratio (IR) is a key performance metric that evaluates how effectively an investment manager generates excess returns relative to a benchmark, considering the risk taken.

Step 1: Starting Universe

The process begins with the NIFTY 500, ensuring broad diversification across sectors and market capitalisations.

Step 2: Sector-Level Signal Evaluation

Each sector is assessed using multiple factors such as valuation, growth and quality indicators, momentum, macro trends, and analyst sentiment. These inputs are processed using advanced analytics and alternative data sources to generate sector-level alpha scores.

Step 3: Portfolio Construction and Risk Control

These scores are fed into Aladdin, BlackRock’s proprietary platform which is licensed to the JioBlackRock AMC. The Aladdin Optimisation Engine integrates fund manager inputs, security level risk modelling, and estimated transaction costs to balance return potential with appropriate risk controls.

Step 4: Defining Active Weights for Each Sector

Active weights for each sector are generated, and a final optimised portfolio is constructed by combining sector and stock-specific inputs, governance filters and liquidity filters, etc.

Why Indian Markets Are Ready for JioBlackRock Sector Rotation Fund

India’s equity markets have matured significantly over time, making them well-suited for systematic approach.

- Indian equities market growth: India's market cap has grown to ~$5.4tn as on 31st Dec’251 and it constitutes 16.48% to MSCI EM all cap (IMI) index (Dec 2025)2

- Expanding stocks breadth: A noticeable increase in IPOs in India with more e-commerce and digital firms moving from private to public sectors, boosting the market growth3

- Diversification within sectors: Relative to other emerging markets, India's equity market has a more balanced and diverse industry composition4

1. BSE India (All India Market Cap), 2. MSCI , 3. Screener & internal research, 4. MSCI India Index & internal research

Together, these factors can make data-driven, rules-based investing potentially far more effective today than in the past.

Why Consider the JioBlackRock Sector Rotation Fund?

There are a few reasons this fund may appeal to long-term investors:

-

Professional Active Fund Management

Data, tech and AI help our fund managers spot suitable sector opportunities while minimizing emotional bias. -

Total Expense Ratio (TER)1 and Exit Load

Reasonable TER of 0.5% and no exit load, so more of your money can stay invested without unnecessary charges. -

Risk Managed Strategy

We aim to beat the Nifty 500 by taking small, diversified positions and carefully managing risk across sectors.

1TER shown above is for indicative purposes only and does not reflect the actual TER. Please refer to the Scheme Information Document for the maximum permissible TER chargeable by the scheme. Post NFO, Investors are suggested to visit AMC’s website for the actual TER of the Scheme.

The Bottom Line

Markets often shift over time. Sectors that shine today may lag tomorrow. Hence, a Sector Rotation fund could offer a disciplined alternative, combining diversification with adaptability. For investors who believe that market cycles matter and want a smarter way to navigate them, the JioBlackRock Sector Rotation Fund may be one of the options as it represents a technology-enabled approach worth considering as part of a long-term equity allocation.

Disclaimers:

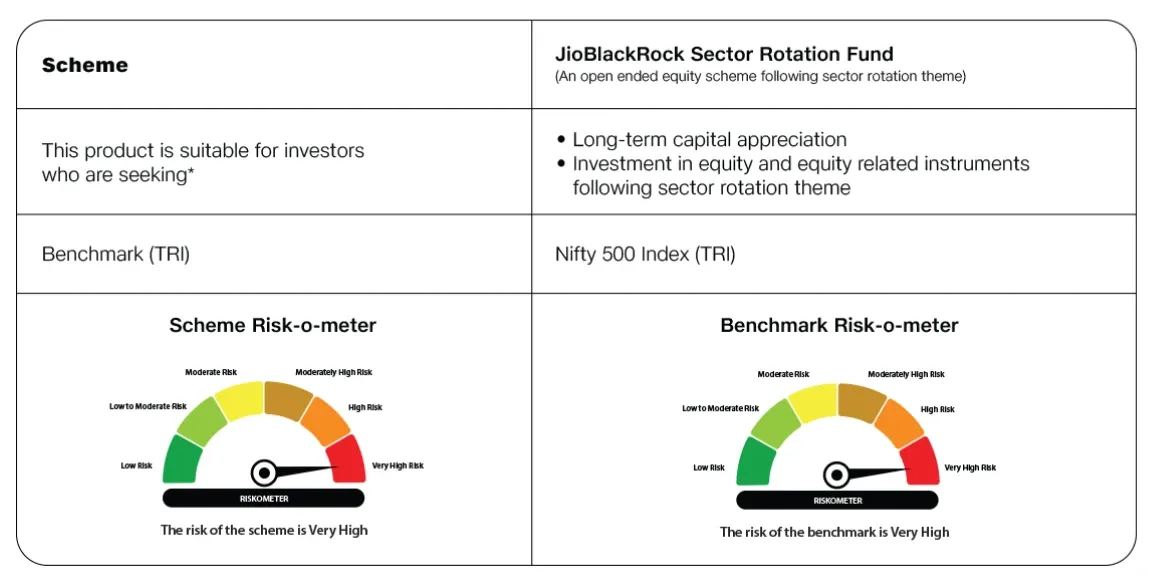

Risk-o-Meter & other details