Arbitrage Funds Explained: Low-Risk, Tax-Efficient Investment for Short-Term Targets

Arbitrage Funds Explained: Low-Risk, Tax-Efficient Investment for Short-Term Targets

Imagine its peak mango season. A vendor notices mangoes selling for ₹80 per kilo in a nearby village, while customers in the city are willing to pay ₹120 per kilo for the same fruit. The vendor quickly buys at ₹80 and sells at ₹120, locking in the difference. That’s arbitrage, buy where it’s cheaper, sell where it’s higher, and secure the spread upfront.

Now, how does this concept apply to investing? Arbitrage funds work on the same principle only with stocks.

To understand this better, let’s look at the two segments of the equity market:

- Cash Market: Where shares are bought and sold at the current price for immediate delivery.

- Futures Market: Where you agree on a price today for delivery in the future.

What drives returns in an Arbitrage Fund?

Returns in an arbitrage fund are primarily influenced by market dynamics, which are shaped by a mix of domestic and global factors—government and monetary policies, investor sentiment, major macroeconomic shifts, and geopolitical developments.

These factors often lead to heightened market volatility, creating more frequent and wider price gaps between the cash (spot) and futures markets. Larger spreads mean greater opportunities for arbitrage, which can translate into higher potential returns for the fund.

In addition to volatility, other key drivers include:

- Liquidity in the market

- Prevailing interest rate environment

- Overall market sentiment

- Number of stocks available in the F&O universe

How do Arbitrage Funds compare with other investment options?

When exploring short-term investment avenues, arbitrage funds stand out for their unique blend of stability, liquidity, and tax efficiency.

Unlike many traditional fixed-income instruments, arbitrage funds are treated as equity-oriented for tax purposes, which offers a significant advantage:

- Short-Term Capital Gains (holding < 12 months): Taxed at 20%

- Long-Term Capital Gains (holding ≥ 12 months): Taxed at 12.5% on gains exceeding ₹1.25 lakh

On the other hand, traditional investments can attract taxes of up to 30%1 for individuals in the highest income bracket.

This combination of better tax efficiency and high liquidity makes arbitrage funds an attractive choice for parking short-term surplus typically with an investment horizon of three months or more.

Why invest in Arbitrage Funds?

- Potential of better returns than traditional saving options

- benefits from equity taxation

- Seeks to capture price differences between cash and futures markets for stable returns.

The JioBlackRock Edge

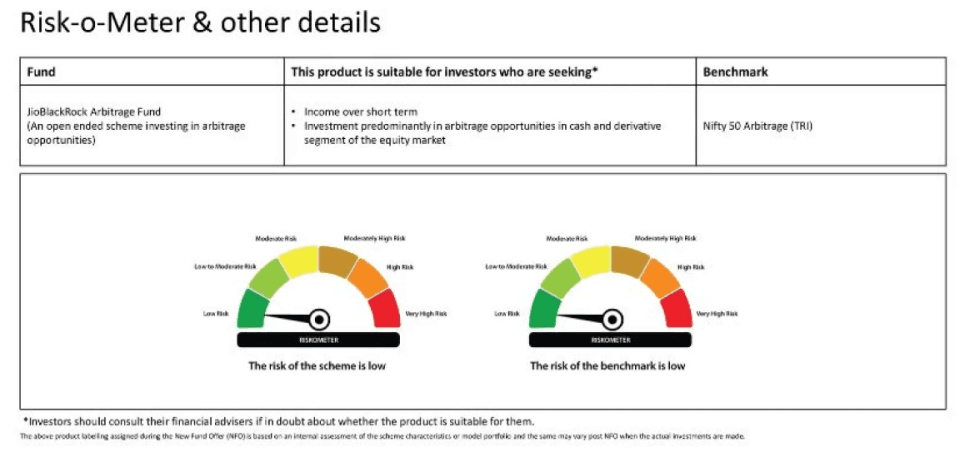

The JioBlackRock Arbitrage Fund seeks to combine global expertise with local strength. Backed by BlackRock’s decades of investment experience2, the fund aims to leverages advanced analytics and technology to capture spreads efficiently.

Here’s what sets us apart:

We aim to bring a unique edge by applying quantitative analysis to rollover decisions, ensuring data-driven and optimized outcomes.

You may be wondering what are “roll overs”?

In arbitrage fund, managing contract expirations effectively is critical for fund performance. Futures contracts come with fixed expiration dates, requiring fund managers to ‘roll over’ positions into new contracts. The timing and terms of this rollover can significantly impact returns, making a data-driven approach essential

The Quantitative Edge

To optimize roll spreads, we employ a three-step framework:

- Observe: Track month-on-month spread movements and futures open interest movement.

- Analyse: Compare with historical averages & volatility.

- Act: Execute rollovers when spreads are relatively attractive, ensuring swift and scalable decisions.

This structured approach can empower fund managers to make smarter, timely rollover choices, leveraging quantitative insights.

Who should invest?

- Risk-Averse Investors: Who aims for steady returns and wants to avoid the ups and downs of the stock market.

- Income-Focused Savers: May suit investors seeking relatively stable income with limited exposure to interest rate or credit-related risks

- Tax-Savvy Investors: Focused on maximizing post tax gains and seeking investments with favourable tax treatment.

- Short-Term Planners: Those who desire predictable income streams without taking on interest rate or credit related risks ideal for cautious investors.

In today’s dynamic markets, investors seek solutions that offer relatively stable, low risk, and are tax efficient. Whether you need to park short-term surplus or manage your portfolio with a low-risk approach, this fund provides a strategy designed to align with your financial target.

Disclaimers

1 Surcharge and other taxes not considered. It will be applicable as per investor tax bracket in addition to this.

2 https://ir.blackrock.com/news-and-events/press-releases/press-releases-details/2017/BlackRock-Completes-Acquisition-of-Cachematrix/default.aspx