Digitization, demographics to drive India’s next consumption wave

Digitization, demographics to drive India’s next consumption wave

Issued by BlackRock Investment Institute

Domestic growth has moderated, and equity valuations — particularly in small- and mid-cap segments — have come off the boil. Still, the Reserve Bank of India’s recent shift to an accommodative stance, along with a drop in oil prices, offers a measure of near-term support for the energy-importing economy.

Beneath the surface, we believe a deeper transformation is underway — one that points to sustained opportunity over the medium- to long-term. We see India’s structural growth story as intact and increasingly driven by the intertwining of two mega forces: digitization and demographics. Together, they are reshaping how Indian households consume, save, and invest.

This convergence is powering two big shifts investors should watch: the rise of a broader, digitally connected consumer base beyond the elite; and the growing role of capital markets in drawing first-time investors into the fold.

Digitization and demographics: unlocking the next wave

India’s digital transformation is no longer confined to early adopters. The Unified Payments Interface (UPI) — India’s instant, mobile-based payment system launched less than a decade ago — now facilitates nearly 10 billion transactions each month. Alongside it, Aadhaar — the country’s unique biometric identification number that serves as proof of identity and address — has enabled seamless digital onboarding for financial services.

The rapid scaling of this infrastructure has reshaped how people transact, save, and invest. More households are engaging with financial products through smartphones and low-cost apps. What was once cumbersome and paperwork-heavy is now mobile-first and near-instant — opening up new pathways for everyday Indians to participate in the formal economy.

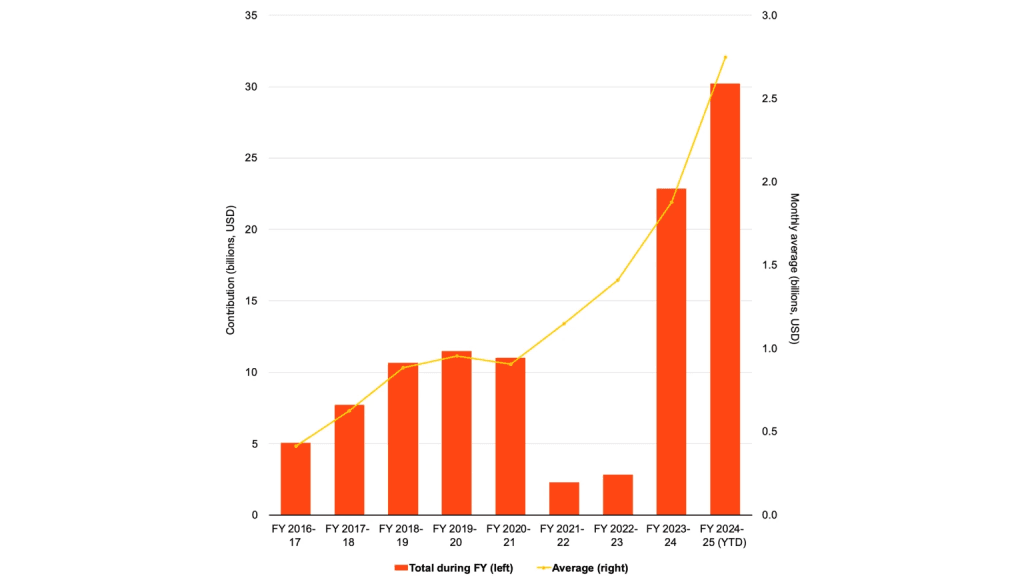

The result is visible not just in spending patterns but in how households approach saving. More Indians are now investing through systematic investment plans (SIPs) — small, fixed monthly contributions to mutual funds. The average SIP is ₹2,557 (around $30), yet total flows reached ₹260 billion (about $3 billion) in February alone. What was once the preserve of the affluent is becoming mainstream — driven by digital onboarding, low transaction thresholds, and the ease of investing directly from a mobile phone.

Starting small

Monthly systematic investment plan contributions, 2016-2025

Source: BlackRock Investment Institute, with data from AMFI, India. March 2025. Note: the chart shows the monthly SIP contributions into mutual funds across the industry from fiscal year 2016-27 onwards to latest available data for February 2025.

These digital gains are converging with one of India’s biggest structural advantages: a growing workforce. Unlike many large economies where labor pools are shrinking, India’s working-age population is expected to rise for another two decades. Urbanization combined with broader access to education and financial tools are adding further momentum. When digital platforms and AI tools meet population scale, productivity gains can compound — laying the groundwork for more durable growth.

One of the clearest shifts underway is in consumption. For years, spending power was concentrated at the top — a narrow band of households with the income and access to drive demand. That group remains important, but a new tier is starting to participate: a digitally connected, economically confident middle class. This isn’t a handover — it’s a broadening of the consumption base.

Investment implications

India is not insulated from global market corrections. Risk-off sentiment, tighter financial conditions, and geopolitical shocks can still unsettle markets. Recent weakness has followed a period of strong outperformance versus broader emerging markets over the past five years. Equity valuations — particularly in small- and mid-cap segments — have also cooled from their late-2024 highs. MSCI India trades at about 20 times forward earnings compared to an average around 18 times over the past two decades – and below the all-time high of 25 times in October 2024, according to LSEG data. We estimate India’s equity risk premium, our preferred valuation gauge since it considers both earnings growth expectations and prevailing interest rates, to be around 4.9%, close to its long-term average. We believe the bigger story is structural, not cyclical. A growing, digitally enabled middle class is reshaping both consumption and capital allocation — and that opens up a range of long-term opportunities for investors.

We see medium- to long-term opportunities in sectors aligned with this shift:

- Financial services — including small-ticket lending, deeper mortgage penetration, and investment platforms that broaden market access.

- Consumer staples and retail — as digital distribution channels reach more households across tier-2 and tier-3 cities.

- Digital platforms and e-commerce — where growth is picking up beyond the metros.

At the same time, business models built around high-cost, urban-centric formats — or slow to adapt to a younger, more digital and value-conscious customer — may face growing pressure. Mass-market participation in capital markets is still in its early stages, but it’s laying the foundation for more stable, recurring flows of capital. In our view, this is India’s prosperity flywheel at work — one that could continue to turn for years to come.

Meet the author

Ben Powell

Chief Middle East and APAC Investment Strategist, BlackRock Investment Institute

Disclaimers

The information contained in this article is for general purposes only and not an investment advice in any manner. Investors should seek professional advice before taking any investment-related decisions.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

SIP does not assure a profit or guarantee protection against loss in a declining market. The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the investors. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. The Sponsor, the Investment Manager, the Trustee or any of their directors, employees, affiliates or representatives (“entities & their affiliates”) do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information. Investors are suggested to rely on their own analysis, interpretations & investigations. Investors are also suggested to seek independent professional advice in order to arrive at an informed investment decision. Entities & their affiliates including persons involved in the preparation or issuance of this article shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this article. Investor alone shall be fully responsible for any decision taken on the basis of this article.

Source