10 Essential Things You Need to Know About Index Funds

10 Essential Things You Need to Know About Index Funds

1. What are Index Funds?

An index fund aims to replicate the performance of a specific market index, like the Nifty 50 or the BSE Sensex. Instead of actively picking stocks and trying to outperform the market, an equity index fund invests in the same stocks in the same proportion that comprise the index it tracks. The goal is to match the overall market return, not beat it.

2. A Simple Way to Diversify

Investing in an index fund is a simple way to diversify your investment holdings. For instance, the Nifty 50 index fund includes shares of the 50 largest and most liquid Indian companies listed on the National Stock Exchange (NSE).

Pro tip: Although index funds are often considered safer than individual stocks, they still carry risk. The value of your investment can fluctuate with the broader market. However, due to their diversification benefits, index funds are less volatile than individual stocks. Over time, they tend to recover from market downturns, which is why they are favored for long-term growth.

3. Track Record

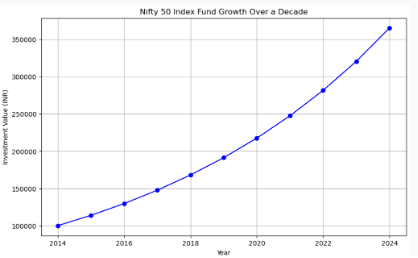

Historically, index funds have delivered strong, consistent returns over the long term. Since index funds track the market, their performance reflects overall market sentiment, making them ideal for a long-term investment plan.

For example, if you had invested INR 1,00,000 in a Nifty 50 Index Fund a decade ago, your investment would have grown to INR 3,65,387, reflecting an annualized return of 13.83%, according to the Nifty 50 Index values as of September 30, 2024. Source: AMFI

4. Tracking the Difference between the Fund and the Index

Investing in index funds may seem straightforward, but it's important to understand what “tracking difference” is. Tracking difference refers to the gap between an index fund's performance and the performance of the underlying index the fund aims to replicate. A low tracking difference means the fund closely follows the index, while a high difference could be due to factors like expenses, periodic rebalancing, implementation of corporate actions etc. This can affect your return. The lower the tracking error, the better the fund is mirroring the index returns.

5. A Low-Cost Investment Option

Expense ratios represent the annual fees and other administrative costs that you pay when investing in a mutual fund. The ratio is expressed as a percentage of your investment. For example, if an index fund has an expense ratio of 1% annually, it means that for every ₹1,000 you invest, you will pay ₹10 per year in fees. This fee is automatically deducted from the fund’s assets thus reflecting in the Net Asset Value or NAV of the fund. Since index funds simply replicate the index, they have lower expense ratios than active funds, which rely on a fund manager’s expertise to pick and choose stocks. This cost-saving compounds overtime, especially when you are investing for the long term.

6. Rules Based Investing

Index funds are designed to track the market, not outperform it, which means they do not try to 'pick winners' or time the market but instead replicate the underlying index. This rules-based approach leads to lower fees and helps eliminate human biases.

Pro tip: There’s a common myth that index funds are not professionally managed. This is not true; it is just a different management approach. Index fund managers do not spend time trying to pick "winners" or "losers", they try to replicate the underlying index.

7. Rebalancing

Index funds adjust their holdings to match changes in the underlying index on the predetermined date of index rebalancing. For example, if a company is added to or removed from the Nifty 50 or if the weighting of a stock in the index shifted due to market cap changes, the index fund will trade to reflect these changes. Thus the fund manager ensures that the fund always mirrors the performance of the index it tracks without the need for you to take any action.

8. Ideal for Beginners

If you are new to investing, index funds offer an excellent starting point. They offer an uncomplicated way to get exposure to the broader market without the need for in-depth research or stock picking. And they tend to require less monitoring, making them a low-maintenance option for busy investors.

Pro tip: If you are ready to dip your toes into the world of investing, consider starting with an index fund - it could be a very smart move towards your financial future. So, get invested and stay invested – even during periods of market volatility. When it comes to investing, patience tends to pay off!

9. A Long-Term View

Index funds are ideal for long-term investing. They track the market and reflect the overall trend of the broader markets. Long-term investment helps minimize short-term volatility risks while generating returns. Index fund investing relies on trusting the fundamentals of the economy and staying invested for extended periods.

10. Risk and Market Fluctuations

Although investing in index funds is often considered less risky than individual stocks, the value of your investment can change with broader market fluctuations. However, since you are investing in a group of companies, index funds are less volatile than individual stocks.

Bottom Line Whether the objective is saving for retirement, a house down payment, or simply growing your wealth, index funds offer a simple and efficient means of investing in the broader market. Therefore, those ready to begin their investment journey may find that starting with an index fund is a good first step towards securing a prosperous financial future.